Open Enrollment in Metro Detroit, MI

A guide to the Health Insurance Marketplace

Here’s a quick rundown on the most important things to know about the Health Insurance Marketplace,

sometimes known as the health insurance “exchange.”

When you fill out the Marketplace application, we’ll tell you if you qualify for:

- Private health insurance plans. We’ll tell you whether you qualify for lower costs based on your household size and income. Plans cover essential health benefits, pre-existing conditions, and preventive care. If you don’t qualify for lower costs, you can still use the Marketplace to buy insurance at the standard price.

- Medicaid and the Children’s Health Insurance Program (CHIP). These programs provide coverage to millions of families with limited income. If it looks like you qualify, we’ll share information with your state agency and they’ll contact you. Many but not all states are expanding Medicaid in 2014 to cover more people.

Most people must have health coverage in 2014 or pay a fee. If you don’t have coverage in 2014, you’ll have to pay a penalty of $95 per adult, $47.50 per child, or 1% of your income (whichever is higher). The fee increases every year. Some people may qualify for an exemption to this fee. If you enroll by March 31, 2014, you won’t have to pay the fee for any month before your coverage began.

If you have Medicare, you’re considered covered and don’t have to make any changes. You can’t use the Marketplace to buy a supplemental or dental plan.

Using an Insurance Agent… a thing of the past? Think again!

An experienced insurance professional will guide you through the process of plan selection, enrollment, and the management and use of plan’s benefits while in force. They are a FREE additional resource to you and are paid by the insurance companies. They act as the middleman between you and the insurance company, and will fight on your behalf if you are in need of some serious action. This is single-handedly the most valuable and priceless resource available to consumers in the health insurance industry.

Bragging Rights: In the past year, HIA has helped hundreds of individuals find the proper coverage to meet their needs. What’s more is that our agency addressed and resolved thousands of erroneous policy terminations, billing or benefit mistakes by the insurance companies on behalf of our clients (mostly without them ever finding out!). This is a free resource, take advantage of it!

Serving: Metro Detroit | Ann Arbor | South Lyon | Plymouth | Livonia | Novi

Signing Up for Coverage

The new Health Insurance Marketplace and select state marketplace exchanges are now available to provide consumers a platform for accessing health insurance coverage as required by the Affordable Care Act (ACA).

All marketplaces are a fairly new option for individuals and small businesses to purchase health insurance. So, how do you sign up? Here are the steps of the enrollment process to assist you along the way. Tip: We recommend that you call or meet with us, as there are additional and simpler methods of enrolling than through the government’s website.

Step 1: Set Up Your Marketplace Exchange Account

Once you have found the Marketplace website, healthcare.gov, you will need to set up an account on that website. On healthcare.gov, you will need to click “sign up”, “register”, “create an account”, etc. and follow the prompts. You will then be required to provide basic information, and choose a user name, password, and security questions for added protection.

Step 2: Are You Eligible? Fill Out Your Eligibility Application

Not everyone will be eligible for the marketplace plan subsidies, so you will need to fill out an eligibility application. This application will ask questions about you and your family, such as income, household size, current health coverage information, and more. From the information you provide in this section, the Marketplace website will calculate if you are eligible for certain discounts on your health insurance premium,

such as the new premium tax subsidies and cost-sharing subsidies.

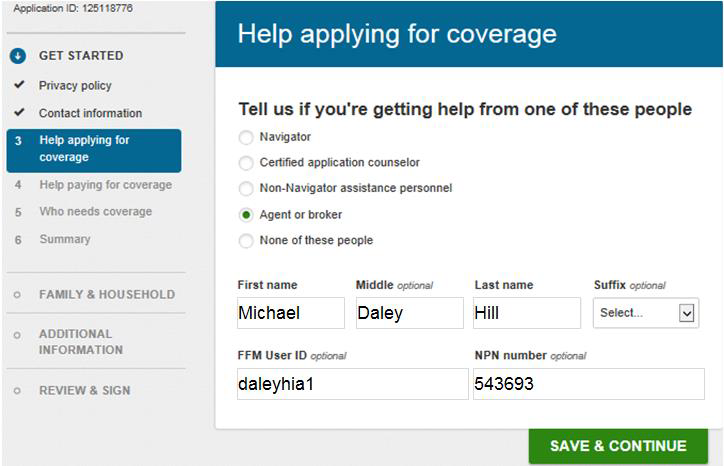

This step is also where you will provide the Marketplace with an insurance agent’s identification, linking us to your policy. This allows you the option of working with an experienced insurance agent who can be of service to you throughout the life of the contract. Any questions you may have on claims, billing, benefits, we’re here to help. Just enter our agency’s information as shown in the picture here.

Note: You won’t pay a penny more working with one versus on your own. And the benefit to you is service throughout the life of the contract. So if you have claims that didn’t process, billing questions or simply want to know what your benefits are at any point in time, instead of trying to do this on your own, you may contact our experience insurance agency to answer all of your questions and help you every step of the way.

Step 3: Choosing Your New Health Insurance Plan: Comparing Plan Rates and Options

Once you have completed your online eligibility application, your marketplace website will provide you and your agent with all plans you are eligible for in a side-by-side comparison. At this point in the process you will be able to see available health plans and compare:

- The benefits offered through each plan

- The monthly cost for each plan, with any discounts applied

- Out-of-pocket costs

- Deductibles

- Copayments

- Coinsurance

- Premiums

Tip: The monthly premium that will be shown on the webpage will have the discount factored in if you qualify for premium tax subsidies. The amount displayed reflects the actual amount you’ll pay every month.

Step 4: Enroll in Your New Plan

Once you select a plan, you will be able to enroll online. Once you’ve enrolled you will provide payment information — how you plan to pay your monthly premiums to the insurance company. If you or a family member qualify for Medicaid or CHIP, you will need to contact the state department directly to enroll.

Tip: Open enrollment on the Marketplace starts November 15 for coverage starting January 1. Check with your agent to find out what changes will be made to your existing plan in the new Plan Year.

Step 5: Peace of Mind

Congratulations on your new health insurance plan. Remember that we work for you, not any insurance company or the Marketplace. Keep our contact information in a convenient location and call us with any questions you may have. We’re always happy to help!

A Handy List of What You’ll Need When You Apply

The basic information you’ll need when filling out the marketplace application is listed below. These questions will only be asked if you are applying for federal assistance (premium tax subsidies, cost-sharing, Medicaid, CHIP, etc.). Be prepared and make sure you have the following information:

- Date of birth

- Social security number & citizenship status

- Tax filing status, and number of dependents

- Current job and income information including current employer, wages, hours worked (ie a current paystub)

- Other income information such as pensions, rental income, alimony received, unemployment income, etc.

- Current insurance information such as how you are insured (employer, Medicaid, individual health insurance, etc.)

- Your agent’s information. Name: Michael Daley Hill; NPN: 543693; FFID: DALEYHIA1

- Access to your email account

- Our information: Health Insurance Administration, Inc.

- Office hours: Monday through Friday 9:00AM – 5:00PM

- Phone: 248.349.8680 or 800.222.0610

- Email: info@hiainc.org

Fill out the form below and we will send you the MODIFIED ADJUSTED GROSS INCOME chart that determines your eligibility for the Affordable Care Act.